JUST IN: Trump Opting for Dramatic Tax Simplifications

President Donald Trump reiterated the need for tax reform in the United States when he made his speech in North Dakota on Wednesday, September 6th. The President talked about his four goals for updating the U.S. tax system.

Joseph Sohm / Shutterstock

To begin with, the President expounded his perspective about the U.S. tax system. He described the tax code as a “self-inflicted economic wound.” He, then, promised to make things easier by reducing tax burdens on individuals and corporations. He hopes to improve the U.S. economy, generate jobs for Americans and restore America’s competitive edge by having these tax cuts and tax reform.

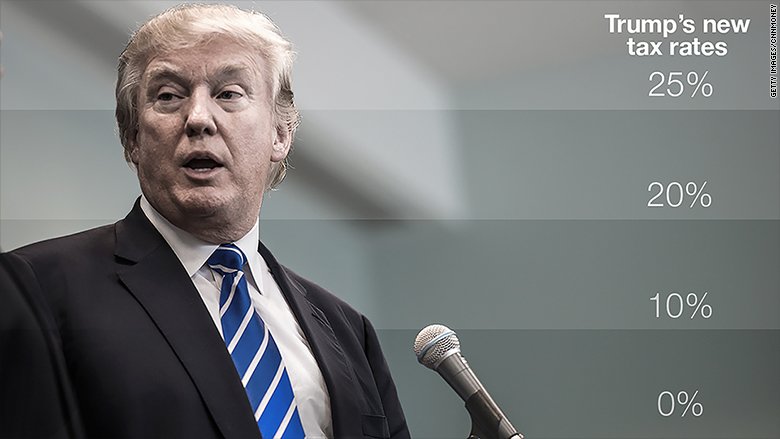

He mentioned that the United State Companies are obliged to “park trillions of dollars overseas” because of high corporate tax rates. He wants to lower taxes on businesses from 35 percent to 15 percent, as noted by CBS News.

He said that the business tax rate in America is the highest in the developed world. He further said that it is nothing more than a crushing tax on every product made in America. So, he hopes to lessen the tax rate on the U.S. business to keep the jobs across the nation.

“It is our time to invest in our country,” said President Trump. “We want to build beautiful new communities and rebuild the old ones, and we want to make America great again.”

The Key Goals

Secondly, is to reduce the taxes for middle-class families. He promised the biggest since the former President Ronald Reagan.

This goal could help Americans keep more of their hard-earned money. The reduced taxation for individuals could strengthen the U.S. economy by encouraging people to work harder, save more, and use their money for investments, according to Adam Michel, a policy analyst in the Thomas A. Roe Institute for Economic Policy Studies at the Heritage Foundation.

He further said that individual tax rates are really high. With this, lowering the tax rates could be very helpful for each individual and to the economy.

Lastly, the President wants tax relief for businesses. As mentioned above, he hopes to cut the corporate tax by 15 percent.

The Daily Signal reports that compared to China’s 25 percent or Ireland’s 12.5 percent, the United States offers one of the least attractive tax business environments in the world.

Michel said that America corporate tax rate is imposed on income earned in other countries. This encourages businesses to keep trillion of dollars overseas. He further said that the combination of the worldwide tax, enforced at internationally high rates, makes America business uncompetitive relative to the rest of the world.

He suggested that America-first tax reform would make America the most attractive place in the world to do business.

“Re-establishing the Economic Dominance”

The President would like to enforce this tax reform for the United States to “re-establish its economic dominance.” He implied that this tax reform will be “pro-growth, pro-worker, pro-jobs, pro-family, and pro-American.”

The president wishes to push tax reforms for his people and their welfare.

For those who want to vote against the tax reform, the President said, “Anyone who is going to vote against tax reform, you need to vote ‘em out of office because it’s so bad.”

Meanwhile, enforcing this tax overhauls could relief each individual and companies of the United States and will improve the nation’s economy making America great again as the President implied.

The President is committed to administering these tax overhaul goals. He said that he is willing to work with both parties namely the Democratic and the Republicans congressional leaders about his tax reform goals.

Certainly, once these tax reform goals were implemented, there would be great changes in the lives of each individual and company regarding their finances.

Trump on Hurricane Harvey Victims

Trump assures that the government puts the victims of any calamities in its priorities.

Meanwhile, the President was reminded of those affected by Hurricane Harvey and the approaching Hurricane Irma that will hit Florida in the coming days. He offered thoughts and prayers for them. He said that their hearts are heavy with sadness.

“Together we will recover and we will rebuild,” said Mr. Trump.

More in Legal Advice

-

`

What Is DRI in Real Estate?

What is DRI in real estate? Understanding DRI in real estate is crucial when dealing with large-scale developments. DRI, or Developments...

August 31, 2024 -

`

What Is an Irrigation Bill and Why Do You Need to Pay It?

If you’ve recently received an irrigation bill and are wondering, “What is an irrigation bill?” you’re not alone. These bills might...

August 23, 2024 -

`

What Happens When a Landlord Refuses Rent? Legal Rights and Options

Landlord troubles? Are rent checks bouncing back like a bad penny? Fear not, tenant. This guide is your lifeline through the...

August 17, 2024 -

`

Bank Statement Mortgage Loan: What Is It and Who Should Get One?

If you are wondering, what is a bank statement mortgage loan, you are not alone. This type of loan is a...

August 7, 2024 -

`

Are Sabrina Carpenter and Olivia Rodrigo Friends?

The question on many fans’ minds is, “Are Sabrina Carpenter and Olivia Rodrigo friends?” This curiosity stems from the buzz around...

July 29, 2024 -

`

What Is Provisional Credit and How It Works for You

Have you ever noticed an unexpected credit in your bank account labeled as provisional? It can feel like a financial windfall,...

July 24, 2024 -

`

How Old Do You Have to Be to Rent an Apartment?

Transitioning from living at home to renting your first apartment is a significant step towards independence. But how old do you...

July 20, 2024 -

`

Will Lumber Prices Go Down in 2024? A Market Forecast

The price of lumber has been a source of frustration for many in recent years. From record highs to a period...

July 12, 2024 -

`

Travis Kelce and Taylor Swift All Set to Tie the Knot?

Travis Kelce and Taylor Swift are almost all set to tie the knot! The buzz around their engagement has fans on...

July 1, 2024

You must be logged in to post a comment Login