How Living Overseas Can Make Your Retirement Fit for the Gods!

You once lived life in the fast lane; boy was it great when the time was still plentiful. Fast forward a few decades later and its hit you…

You’ve grown old.

The kind of old where middle-aged adults, especially in their 30s, take their hats off to you when you’re entering a restaurant. How splendid!

All you need now is to secure your retirement piggy bank and you’re good to sample all of life’s splendor! Yep, dine at the most exquisite venues, vacation at the most beautiful places on earth, and meet the most beautiful smiles on the planet.

Unfortunately, there’s one thing that all these marvelous dreams need to include. Money! Sadly, it might not be the easiest commodity to come by during retirement.

That’s right.

Indeed, this is right up the list with some of the proverbial fears that most old people face. Yes, even the common calling your grownup kids and just wishing they would pick up the phone. *sigh*

Nevertheless, there’s also another fear that lingers in the back of your mind as a retiree that you may not even realize is there in the first place. In fact, it only becomes a major issue the day you hear the first signs of that distant cough. It’s called worrying about paying for healthcare.

Yes, that’s right.

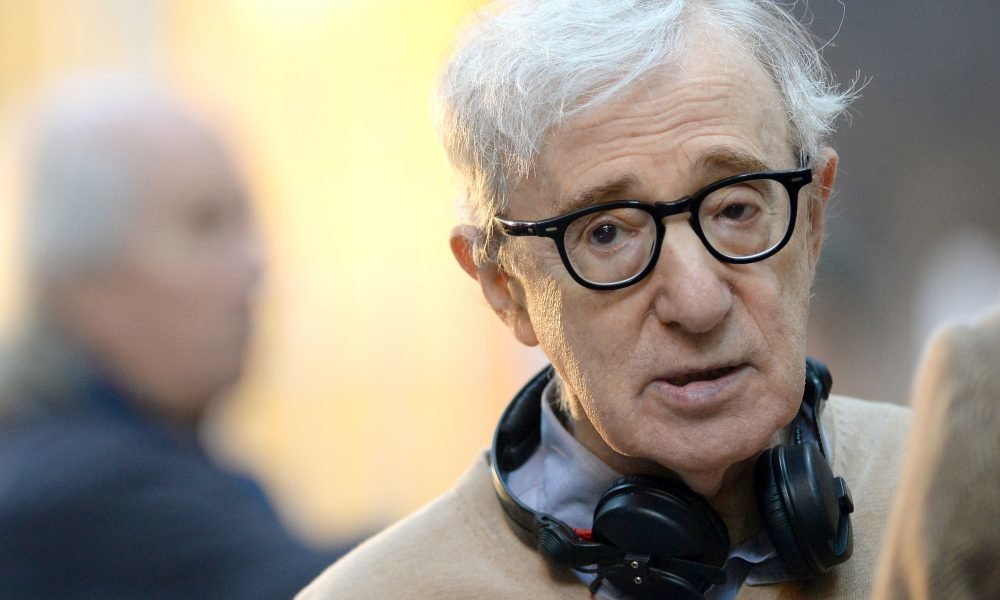

Retiring overseas can be beneficial financially

A Life Overseas

However, there are two sides of the coin. Instead of spending an eternity at home just to cut you’re spending and denying yourself the right to live a little, why not take the adventure overseas?

It might sound daring, but it can certainly be worth your while.

For instance, it could save you millions in terms of expenditure according to data released by InternationalLiving.com which analyzed a number of couples that were living overseas and had received bargains in the regions that they lived in.

Everything from cheaper meals out, cheaper healthcare, and cheaper housing. Let’s also not forget the best of the best, cheap luxury!

One fine example of such a case scenario is that of Edd and Cynthia Staton who relocated to Ecuador in order to salvage their retirement savings that had was almost compromised by the financial crisis that rocked the nation in 2008.

The Statons, who have documented their expeditious travels in quite a number of books, have vividly described how they are living it large in Cuenca, Ecuador. For example, they are able to afford a weekly housekeeper which would have cost them a fortune in the U.S.

Oh, and what about their day-to-day life? Yes, it includes the likes of mani-pedis, facials, as well as massages. You heard right, special treatment that’s only used for special occasions!

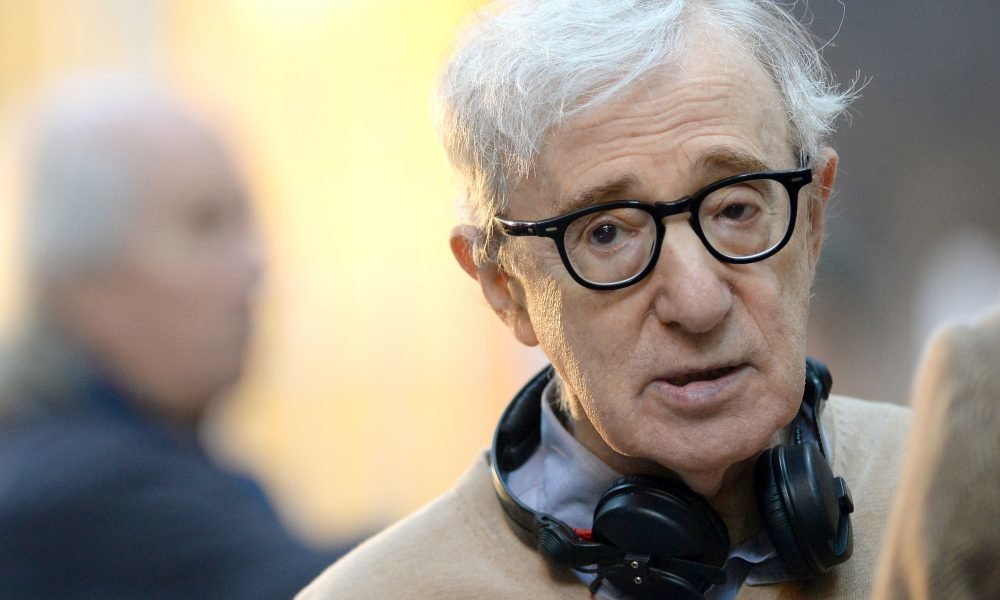

Not only will you enjoy a spectacular lifestyle, but breathtaking scenery

Affordable Lifestyle

Moreover, the retired couple also discovered that they have massive discounts for everyday costs. For example, housing in Ecuador is quite cheap. For a luxurious penthouse with 4 bedrooms and 41/2 bathrooms, the rent comes to an affordable $700 a month!

Additionally, since the Statons are over the age of 65, they pay roughly 15 cents when they use local transport (which is half the price for adults that are not seniors who pay 30 cents).

Moreover, a cab ride across town costs roughly $3

Apart from this, they also pay less than $60 a month when handling their utility bills, which include gas, sewer water, and electricity.

That being said, perhaps the most intriguing part is that when costs increase, the Statons only feel a slight effect.

Healthcare is much more affordable in such countries as compared to the United States

Great Healthcare and Investment Options

Additionally, when it comes to healthcare, the bargain is tremendous in Ecuador. The couple, for example, spends an affordable $81 per month on health insurance which includes a 100 percent coverage and no restrictions regarding pre-existing conditions as well as age.

As a matter of fact, when Cynthia was unwell, the doctor even went as far as making a surprise visit to their apartment to monitor Cynthia’s condition.

Indeed, since their monthly budget is below $2000, the Statons can afford such a wonderful lifestyle through the funds they receive from their Social Security alone.

Which means that they do not have to touch their savings, which mind you compound interest as time goes by.

Another major plus for living in Ecuador is that the couple gets a hearty return on their investments.

More in Pocket Change

-

`

What Is DRI in Real Estate?

What is DRI in real estate? Understanding DRI in real estate is crucial when dealing with large-scale developments. DRI, or Developments...

August 31, 2024 -

`

What Is an Irrigation Bill and Why Do You Need to Pay It?

If you’ve recently received an irrigation bill and are wondering, “What is an irrigation bill?” you’re not alone. These bills might...

August 23, 2024 -

`

What Happens When a Landlord Refuses Rent? Legal Rights and Options

Landlord troubles? Are rent checks bouncing back like a bad penny? Fear not, tenant. This guide is your lifeline through the...

August 17, 2024 -

`

Bank Statement Mortgage Loan: What Is It and Who Should Get One?

If you are wondering, what is a bank statement mortgage loan, you are not alone. This type of loan is a...

August 7, 2024 -

`

Are Sabrina Carpenter and Olivia Rodrigo Friends?

The question on many fans’ minds is, “Are Sabrina Carpenter and Olivia Rodrigo friends?” This curiosity stems from the buzz around...

July 29, 2024 -

`

What Is Provisional Credit and How It Works for You

Have you ever noticed an unexpected credit in your bank account labeled as provisional? It can feel like a financial windfall,...

July 24, 2024 -

`

How Old Do You Have to Be to Rent an Apartment?

Transitioning from living at home to renting your first apartment is a significant step towards independence. But how old do you...

July 20, 2024 -

`

Will Lumber Prices Go Down in 2024? A Market Forecast

The price of lumber has been a source of frustration for many in recent years. From record highs to a period...

July 12, 2024 -

`

Travis Kelce and Taylor Swift All Set to Tie the Knot?

Travis Kelce and Taylor Swift are almost all set to tie the knot! The buzz around their engagement has fans on...

July 1, 2024

You must be logged in to post a comment Login